Nearly one year after the World Health Organization discovered the coronavirus, many people are still staying home from offices, schools, movie theaters, stadiums, churches and restaurants. A lot of the socialization that would be happening in those places in 2020 is happening over video calls. And you can’t talk about that aspect of life without talking about Zoom.

Zoom seemed to come from nowhere. It wasn’t backed by Cisco, Facebook, Google or Microsoft, although those companies all sought to catch up with Zoom. A small company that was geared toward adoption in large companies suddenly found itself slammed with people trying the service for free, as well as thousands of new paying customers. Revenue quadrupled and profit increased 90-fold, catching analysts by surprise. The stock went higher and higher, easily standing out as one of the top stocks of the year — alongside the likes of vaccine maker Moderna and Chinese Tesla challenger Nio — with a gain of more than 450%.

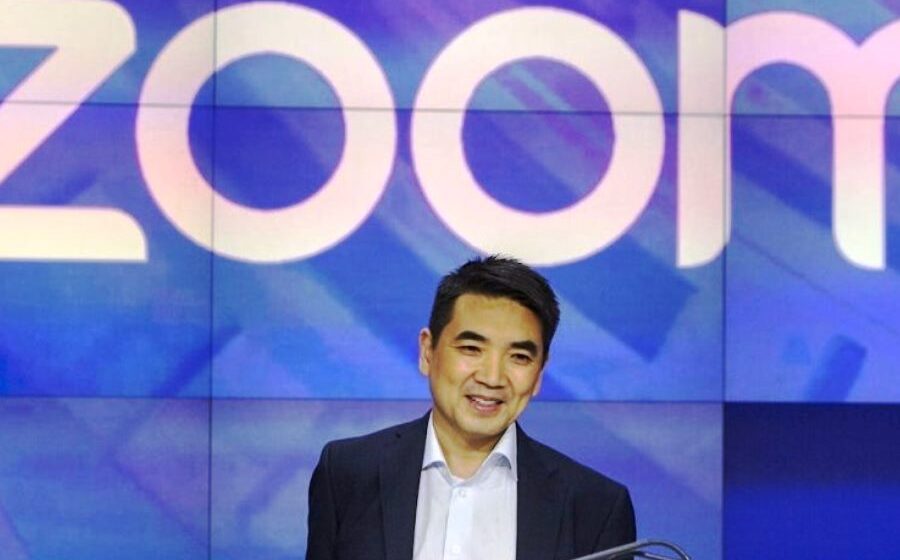

That’s been helpful for the founder and CEO of Zoom, Eric Yuan, who previously worked on the Webex video calling software that Cisco bought in 2007. Yuan was already a billionaire before Covid-19, having taken Zoom public in April 2019 and impressed investors with the combination of fast growth and profitability. Now he’s one of the world’s 100 richest people. His Zoom shares are worth almost $17 billion, according to FactSet.

“I’m very happy for him. Really, I really am,” said Rob Bernshteyn, CEO of Coupa, whose cloud software helps companies keep track of purchases. Bernshteyn has known Yuan for four or five years, and Coupa has long been a Zoom customer. The only thing that changed with Zoom usage at Coupa is the company started letting employees use their corporate Zoom accounts for personal meetings.

“I use the word happy,” Bernshteyn said. “It’s one of the things he’s said from day one, wanting to make sure this platform creates happiness. He sure as heck created a great platform and foundation to move in that direction for a lot of people who otherwise wouldn’t have been able to be connected.”

Coupa’s stock has increased 144% this year, an ascent that hardly matches Zoom’s but nevertheless highlights a 2020 trend.

“If digital transformation is accelerating, we probably want to be behind some of the companies that are driving that into the world,” Bernshteyn said, attempting to articulate what investors have been thinking. The WisdomTree Cloud Computing Fund, an exchange-traded fund that tracks an index of cloud companies maintained by venture-capital firm Bessemer, has grown 119% this year.

Zoom’s expansion hasn’t always come easily. In the spring, after Zoom found itself on the receiving end of unprecedented demand, the company was also bombarded with concerns about the software’s privacy and security. Then came the questions about Zoom and Yuan’s connections to China. Nancy Pelosi, speaker of the House of Representatives, called Zoom a Chinese entity on live television.

Yuan responded by issuing a post on a corporate blog.

“I became an American citizen in July 2007,” he wrote. “I have lived happily in America since 1997. Zoom is an American company, founded and headquartered in California, incorporated in Delaware and publicly traded on Nasdaq.”

In June, after Zoom said it had shut down accounts that had hosted meetings commemorating the 1989 protests in Beijing’s Tiananmen Square, after the Chinese government had brought the meetings to Zoom’s attention. Sen. Josh Hawley, a Republican representing Missouri, sent Yuan a letter saying his company appears to have opted to support censorship rather than free speech. “Are you trying to curry favor with the Chinese Communist Party?” Hawley wrote.

Yuan told analysts on the company’s fiscal first-quarter earnings call in June that, between the usage surge and what he called negative PR, he had been confronting serious pressure. He said that other CEOs conveyed their support and offered advice.

Weeks later Subrah Iyar, the head of Webex at the time of the acquisition and an early Zoom investor, came to Yuan’s defense.

“I’ve known Eric since the day he came to the United States,” Iyar said in a video posted on his LinkedIn page. “He’s one of the most sincere individuals I’ve ever met. He embodied the culture we tried to inculcate with Webex: a win-win with our customers, with our partners with our employees.”

All the pressure might well have been worth it. Today, according to Bloomberg estimates, Yuan is worth two times more than Marc Benioff, co-founder and CEO of Salesforce, which has sold companies cloud software for to keep track of clients since 1999. At Salesforce’s investor day earlier this month Benioff, praised Zoom for the role it can play for salespeople who can’t meet with customers in person.

“I don’t think there’s been a more important moment in history for sales organizations, B2B sales organizations,” Benioff said. “Those sales organizations who did not automate, who did not know how to use Zoom, who did not know how to use Salesforce, they were at a very significant disadvantage this year.”

Benioff has a record of making donations, and his company has long provided grants to nonprofit organizations. Yuan isn’t there yet, although this year Zoom did introduce a charitable giving arm it calls Zoom Cares.

“While the key long-term focuses of this foundation are education, climate change, and social equity, our primary grants in Q1 were toward organizations making a difference during Covid-19,” Yuan was quoted as saying in a statement in June.

Leave a Reply