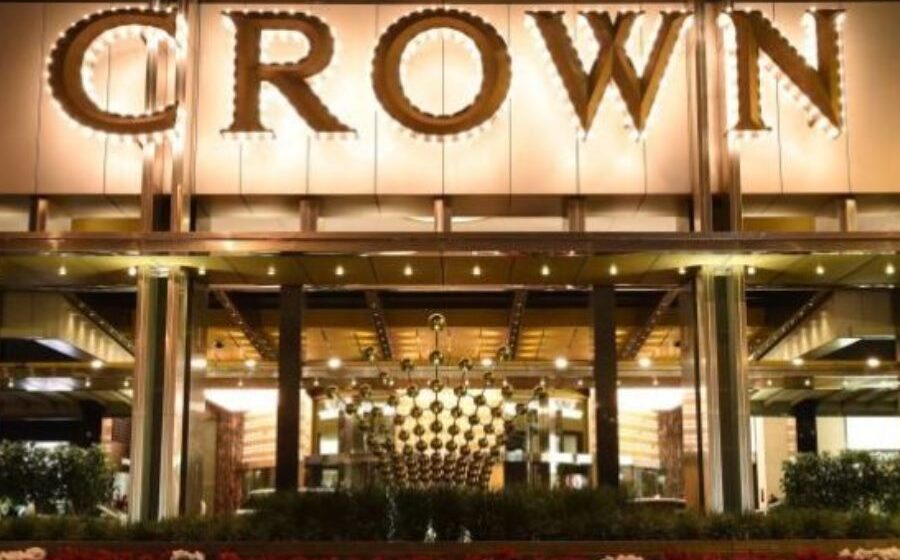

James Packer’s casino operator Crown Resorts has confirmed an $8 billion takeover offer from US private equity giant Blackstone.

The ASX-listed Crown has confirmed an unsolicited, non-binding offer of $11.85 a share was submitted to the company by Blackstone yesterday.

With just over 677 million shares in the company, the initial offer price values Crown at slightly more than $8 billion, which the company said is a 19 per cent premium to its share price since its most recent financial report was released last month.

Blackstone already owns nearly 10 per cent of Crown, which it bought off Melco Resorts in April 2020 for $8.15 per share.

James Packer is the biggest shareholder, with the most recent data on data on Eikon showing Mr Packer’s Consolidated Press Holdings owned around 36 per cent of the casino’s shares.

Crown said its board had not yet formed a view on the merits of the proposal and would commence a process to assess it.

The company said it will also consult with “relevant stakeholders” including regulatory authorities.

Crown was recently on the receiving end of a scathing report commissioned by the NSW Independent Liquor and Gaming Authority.

The Bergin Report concluded the company was currently not fit to hold a casino licence in the state, due to concerns about its governance and the potential for money launderers and other organised crime outfits to exploit its operations.

The report resulted in the departure of Crown’s chief executive as well as a large number of its directors.

Blackstone’s takeover offer comes despite Crown facing royal commissions in Victoria, starting on Wednesday, as well as in Western Australia over its fitness to hold its casino licences in those states, amid money laundering and organised crime concerns.